It is well-documented that brands have integrated technology to enhance their products and services. Enter - EdTech, FinTech, FoodTech, and more. The global market is flooded with companies that are increasingly placing tech at the centre of their business models, and are achieving remarkable user engagement from it.

The edtech industry in particular, has flourished across the world because of the value it has brought to users. In 2022, the global edtech market was valued at $125[1] billion. It is expected to scale further to $232[2] billion by 2027, at a CAGR of 13%[3]. The pandemic was a key catalyst for the mass adoption of edtech. With the closure of traditional learning institutions, parents and teachers were compelled to supplement hybrid learning with elearning apps to help kids continue their education and even gain added skills.

The looming question is, what aspect of elearning mobile apps have contributed to this significant upsurge?

The short answer - gamification.

But here’s why it works. As humans, we are hardwired to achieve. Everytime a child completes a puzzle, he earns a gold star. The reward the kid receives after effectively completing a task acts as an intrinsic driver that facilitates habit-forming behaviors.

In the mobile elearning app landscape, when apps couple learning with fun, gamified concepts and rewards, they resonate well with kids and help develop positive attitudes towards learning.

Gamified e-learning apps have leveraged the need for accomplishment and the promise of a reward to create habit-forming behaviors amongst its users. When kids learn concepts with fun and interactive challenges, they are more likely to retain the information they have learned and even be inclined to learn more. The experiences themselves are highly engaging, featuring tangible goals and achievements which were incentives for kids to return to the app.

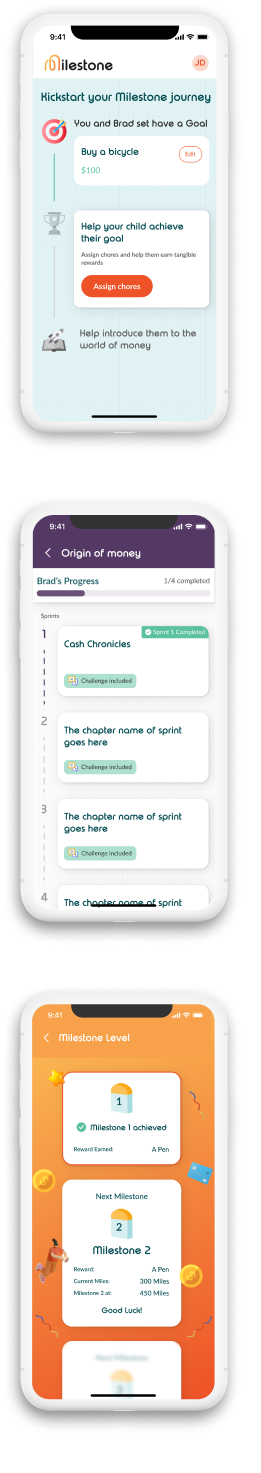

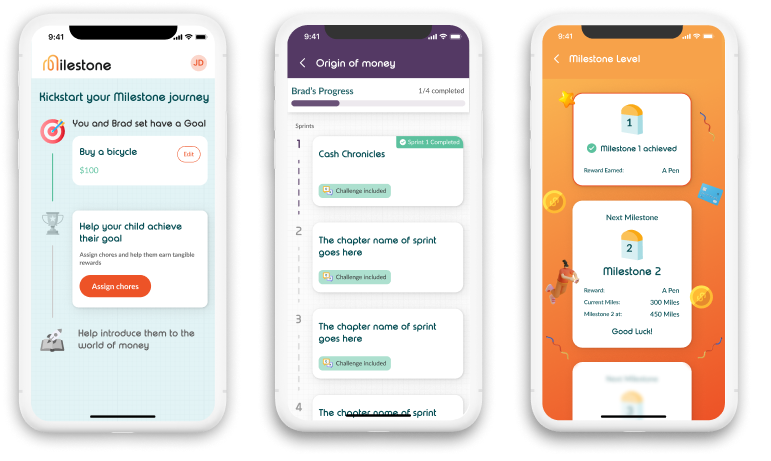

Singapore-based brand Milestone is a financial literacy app whose vision was to empower parents to raise a financially savvy generation. However, the lack of a financial literacy app was a matter of concern for the founders of the brand who are parents and work in the financial space themselves. In the process of conceptualising a mobile app, they were faced with a gamut of challenges ranging from the need to create a mobile app that would engage kids, but not evoke addictive behavior or develop money-minded thinking patterns. Further, since the target users of the app were kids, it was also important to build an engaging and fun learning experience that would retain their interest.

As a result, Milestone wanted to build a financial literacy mobile app that would educate kids about the virtues of money management innovatively and serve as a collaborative platform between parents and their kids. The brand partnered with Arham Labs to build a unique financial literacy learning mobile app that innovatively blended learning with fun. Arham Labs proposed a seamless cycle of Plan-Earn-Spend-Learn to enable kids to learn money management skills.

The app helped achieve the brand’s objectives by featuring goals which kids wished to achieve, rewards they could earn through good habit forming chores, expenditure of virtual money to achieve goals, and the simultaneous learning of financial concepts.

Schedule a 30-minute meeting with us to explore how Arham Labs can create unified omnichannel digital experiences for your brand.

Get in touch